US-China trade war opens a market for African rare earth suppliers

time2019/07/17

- Rare earths are minerals used for a variety of military equipment and consumer electronics. China has only a third of the world’s rare earth reserves, but it accounts for 80% of US imports because it controls nearly all of the processing facilities

The US-China trade dispute has never been just about trade. At stake is US continued control of its technology as China emerges as a rival superpower.

Access to rare earths will be a key part of that struggle, opening opportunities in African countries that are able to provide supply.

Rare earths are minerals used for a variety of military equipment and consumer electronics. China has only a third of the world’s rare earth reserves, but it accounts for 80% of US imports because it controls nearly all of the processing facilities. Rare earth prices rose sharply in May and June as China banned imported rare earths from Myanmar and said it might consider restricting or banning rare earth exports as a retaliatory measure against the US.

Escalation in the US-China trade war is unavoidable, Dariusz Kowalczyk, senior emerging markets analyst at Crédit Agricole CIB, told the Europlace financial conference in Paris on 9 July. There is so much public support in the US for a hard line on China that Trump can’t turn back, and many US businesses want even higher tariffs, he argued.

There is no room for manoeuvre given the red lines that both sides have drawn. A broader economic war, which will include rare earths as a key battleground, is the most likely outcome, Kowalczyk said. He sees a 60% chance of tariff war escalation and says that US tariffs of up to 100% on some products may be imposed.

Increasing demand

US demand for rare earths is growing fast: the estimated value of rare earth compounds and metals imported by the US in 2018 was $160m, versus $137m in 2017, according to the US Geological Survey. That demand, and the China risk, has meant a new focus on African rare earth sources.

The US in June said it has held talks with Malawi’s Mkango Resources, though the Mkango operation is still some years from coming into production.

In June, Galileo Resources, which is listed on London’s Alternative Investment Market (AIM), said that it is assessing the possibility of reactivating the Glenover phosphate and rare earth project in Limpopo, South Africa.

Burundi could be an unlikely beneficiary of the trade war:

The US has also held talks with Rainbow Rare Earths, which operates the Gakara mine in Burundi.

The company says this is by far the highest-grade rare earths mine in the world.

Burundi recorded rare earths extraction of 1,000 metric tonnes in 2018, up from zero the year before.

That was enough to make it instantly one of the world’s top-10 rare earths producers, according to the US Geological Survey.

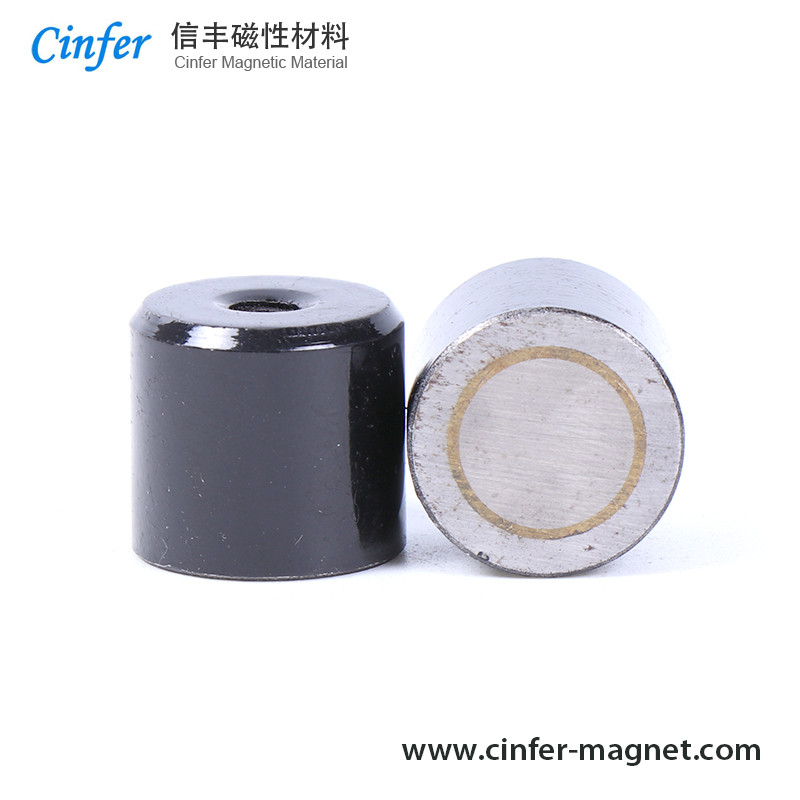

Gakara is the only African mine currently producing rare earths, with output weighted heavily towards the magnet rare earths used in motors, generators, wind turbines and electric vehicles.

The level of reserves that exist in Burundi is still unknown.

Rainbow, also listed in London, is currently seeking to raise a minimum of $5m to invest in increasing rare earths production in Burundi. The company has an offtake and distribution agreement with German industrial engineer Thyssenkrupp.

Bottom line: Lack of rare earths alternatives means that small listed African miners could be a high-risk way to play the trade war.